B.C. Assessment updates 2020 valuations, showing big increases for property owners

David Carrigg • January 11, 2021

Sample shows City of Vancouver detached home values up between five and 10 per cent — and more in Surrey

The B.C. Assessment Authority released its online record of property valuations for 2020 without the usual fanfare.

Traditionally around New Year’s Day, the Crown corporation issues a media release showing the percentage increases in values across different residential property types in different parts of B.C. — plus the total assessed value of all residential property in the province.

The information has been available online since Jan. 1, but the B.C. Assessment Authority waited until Monday to release the details of its valuations.

Which is surprising, because 2020 was a bizarre and totally miscalculated year for B.C. real estate — with the Canada Mortgage and Housing Corporation saying in April that prices could fall up to 19 per cent in 2020, and sales would likely plunge due to COVID-19.

In fact, across Canada residential property prices have jumped 20 per cent in 2020, and it was a record year for sales.

This was driven primarily by further drops in interest rates due to Bank of Canada policy.

In Metro Vancouver, property assessments saw significant gains across the region.

The average assessed value of a single family home in Vancouver has jumped 10 per cent, from $1.567 million in 2020 to $1.717 million in 2021. While the median value of a condominium in Vancouver went up three per cent from $688,000 to $711,000.

Squamish, where the assessed value of an average home inched above the $1 million mark ($1.026 million), was the only other Lower Mainland community to record a 10 per cent increase.

“Despite COVID-19, the Lower Mainland residential real estate market has been resilient,” said B.C. Assessment deputy assessor Bryan Murao. “For the most part, homeowners can expect relatively moderate increases in value. This incredible strength is a stark contrast to last spring when the market came to a temporary standstill whereas the remainder of the year had a very steady and rapid recovery.”

The lone Metro Vancouver region where home assessments dropped was UBC’s Endowment Lands where the average value fell one per cent to $4.923 million.

In fact, across Canada residential property prices have jumped 20 per cent in 2020, and it was a record year for sales.

This was driven primarily by further drops in interest rates due to Bank of Canada policy.

In Metro Vancouver, property assessments saw significant gains across the region.

The average assessed value of a single family home in Vancouver has jumped 10 per cent, from $1.567 million in 2020 to $1.717 million in 2021. While the median value of a condominium in Vancouver went up three per cent from $688,000 to $711,000.

Squamish, where the assessed value of an average home inched above the $1 million mark ($1.026 million), was the only other Lower Mainland community to record a 10 per cent increase.

“Despite COVID-19, the Lower Mainland residential real estate market has been resilient,” said B.C. Assessment deputy assessor Bryan Murao. “For the most part, homeowners can expect relatively moderate increases in value. This incredible strength is a stark contrast to last spring when the market came to a temporary standstill whereas the remainder of the year had a very steady and rapid recovery.”

The lone Metro Vancouver region where home assessments dropped was UBC’s Endowment Lands where the average value fell one per cent to $4.923 million.

In Surrey, the average value of a single family home jumped five per cent from $1.010 million to $1.062 million, while condos went up three per cent from $497,000 to $510,000.

Here’s a few things that can be discerned from the latest B.C. Assessment numbers:

TAHSIS SEES LARGEST JUMP

Province-wide, the community with the biggest leap in assessment values was the Vancouver Island village of Tahsis where the average home climbed 36 per cent from $99,000 to $135,000.

Up north, Burns Lake saw the average valuation jump 21 per cent from $148,000 to $180,000.

Princeton had the largest gains in the Okanagan with the value of the average family home jumping 17 per cent from $215,000 to $252,000.

TAHSIS SEES LARGEST JUMP

Province-wide, the community with the biggest leap in assessment values was the Vancouver Island village of Tahsis where the average home climbed 36 per cent from $99,000 to $135,000.

Up north, Burns Lake saw the average valuation jump 21 per cent from $148,000 to $180,000.

Princeton had the largest gains in the Okanagan with the value of the average family home jumping 17 per cent from $215,000 to $252,000.

CHIP’S HOUSE GOES UP

Lululemon founder Chip Wilson’s Point Grey Road home remains the most valuable in B.C., climbing $1.88 million to $66.8 million. This jump would be relatively meaningless to Wilson, given the value of his Lululemon stock rose around $1.5 billion between July 2019 and July 2020 (based on 12 million shares.)

It’s awful to think of the income disparities that have emerged during COVID-19: as Peter Garrett said “the rich get richer, the poor get the picture.”

Lululemon founder Chip Wilson’s Point Grey Road home remains the most valuable in B.C., climbing $1.88 million to $66.8 million. This jump would be relatively meaningless to Wilson, given the value of his Lululemon stock rose around $1.5 billion between July 2019 and July 2020 (based on 12 million shares.)

It’s awful to think of the income disparities that have emerged during COVID-19: as Peter Garrett said “the rich get richer, the poor get the picture.”

DOWNTOWN EASTSIDE SAHOTA HOTELS VALUED FOR LAND ONLY

In early December the City of Vancouver bought two dilapidated hotels across the road from each other on the 100-block of East Hastings Street in the Downtown Eastside. The city won’t reveal how much they paid for the Regent and Balmoral hotels — to a family they battled for years over dreadful housing conditions. The Tyee has reported the sale price as $11.5 million.

The two eight-storey properties were built before the First World War — Balmoral in 1908 and the Regent in 1913 — and are now almost all land value (with a lot size of 50 by 122 feet). The city has promised it will be converted to supported housing.

The assessed value of both dropped between July 2019 and July 2020 by around 25 per cent to $2.6 million for the Balmoral and $2.5 million for the Regent, almost all in land value.

The Brandiz hotel on the same block was built around the same time as the Regent and Balmoral on the same size lot and has a five-storey building. It has been valued at over $10 million for the past two assessment periods. Most recently, the value of the Brandiz land fell to $2.5 million, while the buildings increased in value by $600,000.

Brandiz is classed by B.C. Assessment Authority as a “beer parlour/hotel” the same as the Regent and Balmoral and is owned by Antonietta and Mario Laudisio. That would make the Balmoral and Regent with working rooms worth $20 million. The city will have to put a lot of work into them, and they could be retained as is, or the whole thing could be demolished and a new facility built.

In early December the City of Vancouver bought two dilapidated hotels across the road from each other on the 100-block of East Hastings Street in the Downtown Eastside. The city won’t reveal how much they paid for the Regent and Balmoral hotels — to a family they battled for years over dreadful housing conditions. The Tyee has reported the sale price as $11.5 million.

The two eight-storey properties were built before the First World War — Balmoral in 1908 and the Regent in 1913 — and are now almost all land value (with a lot size of 50 by 122 feet). The city has promised it will be converted to supported housing.

The assessed value of both dropped between July 2019 and July 2020 by around 25 per cent to $2.6 million for the Balmoral and $2.5 million for the Regent, almost all in land value.

The Brandiz hotel on the same block was built around the same time as the Regent and Balmoral on the same size lot and has a five-storey building. It has been valued at over $10 million for the past two assessment periods. Most recently, the value of the Brandiz land fell to $2.5 million, while the buildings increased in value by $600,000.

Brandiz is classed by B.C. Assessment Authority as a “beer parlour/hotel” the same as the Regent and Balmoral and is owned by Antonietta and Mario Laudisio. That would make the Balmoral and Regent with working rooms worth $20 million. The city will have to put a lot of work into them, and they could be retained as is, or the whole thing could be demolished and a new facility built.

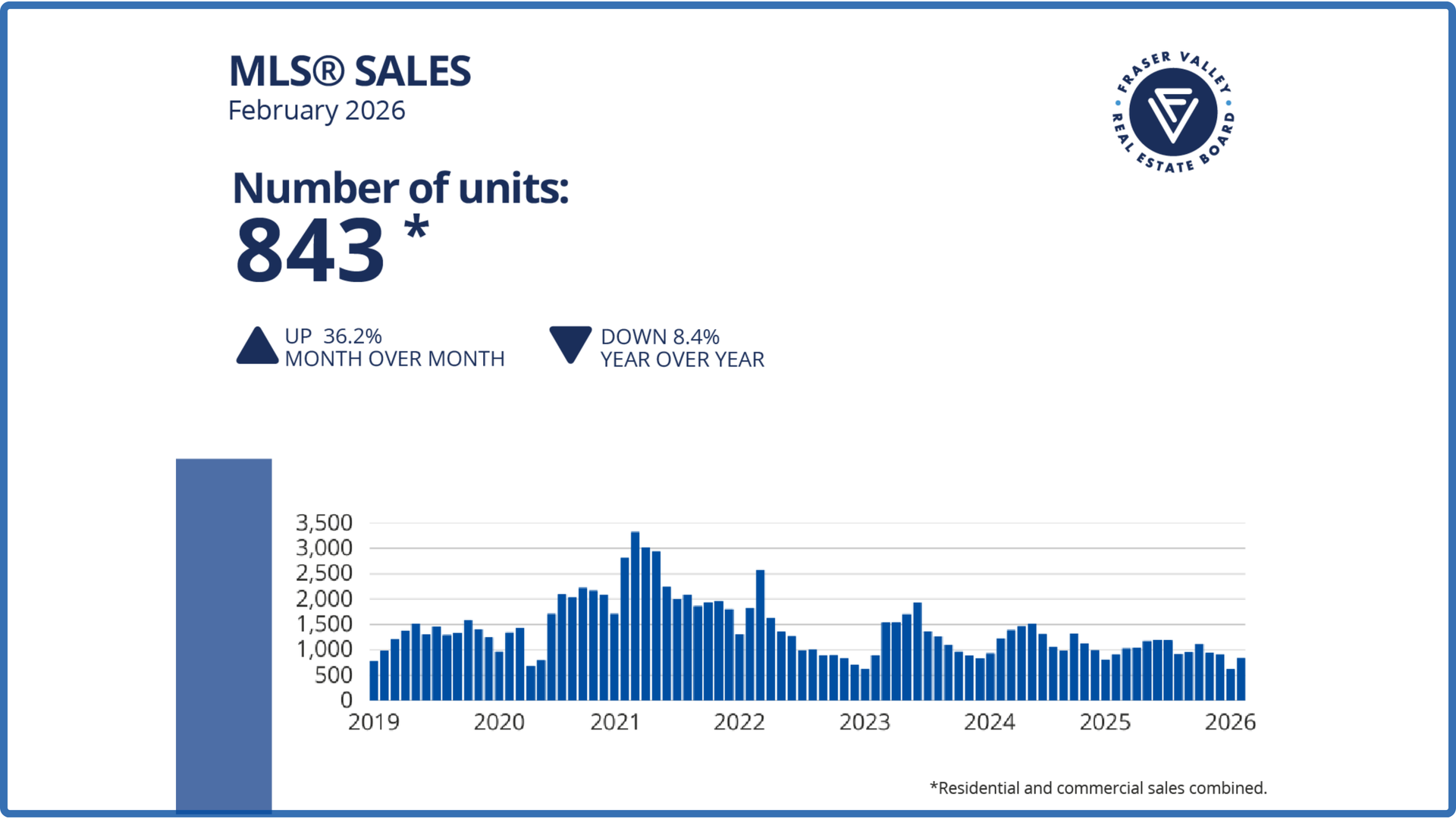

SURREY, BC – The Fraser Valley market showed early signs of a spring thaw in February, with sales increasing over January, but continuing to trail typical levels for this time of year. The Fraser Valley Real Estate Board recorded 843 sales on its Multiple Listing Service® (MLS®) in February, a 36 per cent increase from January, but 38 per cent below the ten-year seasonal average. New listings declined nine per cent in February to 2,796, suggesting some sellers are choosing to wait amid competitive inventory levels, and may be positioning their homes for the peak of the spring market.