NEWS

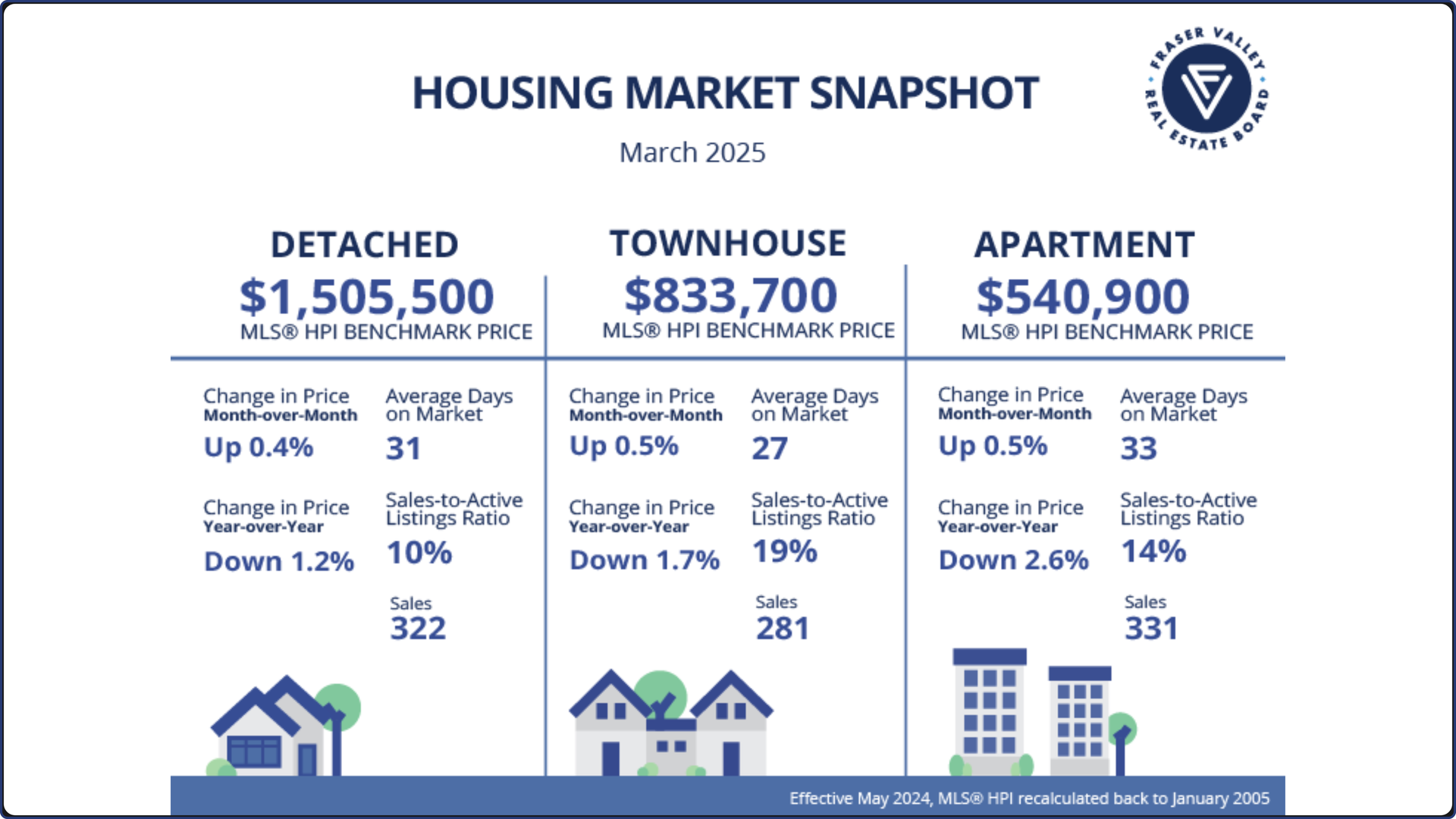

Feeling like the market hasn’t taken off this spring? You’re not alone — April marks the slowest start to the spring Real Estate market in over 15 years across Langley, Surrey, Abbotsford, and the Fraser Valley. In this episode of Andy Talks Real Estate, I break down what’s happening beneath the surface — and what it could mean for your next move. 📊 What’s Covered in This Update: ✅ April 2025 market stats and sales trends ✅ Detached, Townhome & Condo price breakdown ✅ Why the Fraser Valley is still a buyer’s market ✅ What buyers can leverage — and where to be cautious ✅ Why pricing and preparation still matter for sellers ✅ What 30 years of market insight says about what’s ahead Whether you’re looking to buy or sell in Langley or just want to know what’s really going on, this update gives you the clarity you need to move forward. 📊 Full Fraser Valley Market Stats → https://rly.forsale/April-Stats 📅 Book a call a time convenient to you https://calendly.com/andyschildhorn 📞 778.835.8957 📧 [email protected] 🌐 www.AndytheRealtor.com 📍 Serving Langley | Fort Langley | Cloverdale | South Surrey | Walnut Grove | Abbotsford | Fraser Valley

Renting might feel like the easier choice—but is it holding you back from building real wealth? In this episode of Andy Talks Real Estate, we dive into the pros and cons of renting vs. buying in 2025—especially here in Langley and the Fraser Valley, where lower rates and softening prices might open a window of opportunity. Whether you’re renting by choice or just unsure if now’s the right time to buy, this video will help you ask the right questions and plan your next move. 📊 Key Takeaways: ✅ Why renting feels easier—but may cost more long-term ✅ How today’s interest rates + price shifts could work in your favour ✅ What buying looks like if you’re paying $2,000+ in rent ✅ The true cost of waiting vs. the value of building equity ✅ Questions to ask before making a move 📍 Serving Langley | Fort Langley | Cloverdale | South Surrey | Walnut Grove | Fraser Valley 📅 Book a call: https://rly.forsale/Chat-with-Andy 📞 Call/text: 778.835.8957 📧 Email: [email protected] 🌐 Visit: www.AndytheRealtor.com 💬 Are you currently renting in Langley or the Fraser Valley? Thinking about buying but unsure if it’s the right time? Drop a comment—I’d love to hear your story.

Feeling like the market hasn’t taken off this spring? You’re not alone — April marks the slowest start to the spring Real Estate market in over 15 years across Langley, Surrey, Abbotsford, and the Fraser Valley. In this episode of Andy Talks Real Estate, I break down what’s happening beneath the surface — and what it could mean for your next move. 📊 What’s Covered in This Update: ✅ April 2025 market stats and sales trends ✅ Detached, Townhome & Condo price breakdown ✅ Why the Fraser Valley is still a buyer’s market ✅ What buyers can leverage — and where to be cautious ✅ Why pricing and preparation still matter for sellers ✅ What 30 years of market insight says about what’s ahead Whether you’re looking to buy or sell in Langley or just want to know what’s really going on, this update gives you the clarity you need to move forward. 📊 Full Fraser Valley Market Stats → https://rly.forsale/April-Stats 📅 Book a call a time convenient to you https://calendly.com/andyschildhorn 📞 778.835.8957 📧 [email protected] 🌐 www.AndytheRealtor.com 📍 Serving Langley | Fort Langley | Cloverdale | South Surrey | Walnut Grove | Abbotsford | Fraser Valley