Be Life Rich, Not House Poor

Rita Cousins Senior Mortgage Advisor • May 17, 2019

Buying at the top end of your pre-approval price could be setting you up for many dull years to follow.

WHY?????

BECAUSE, YOUR HOME COST IS MORE THAN JUST A MORTGAGE PAYMENT.

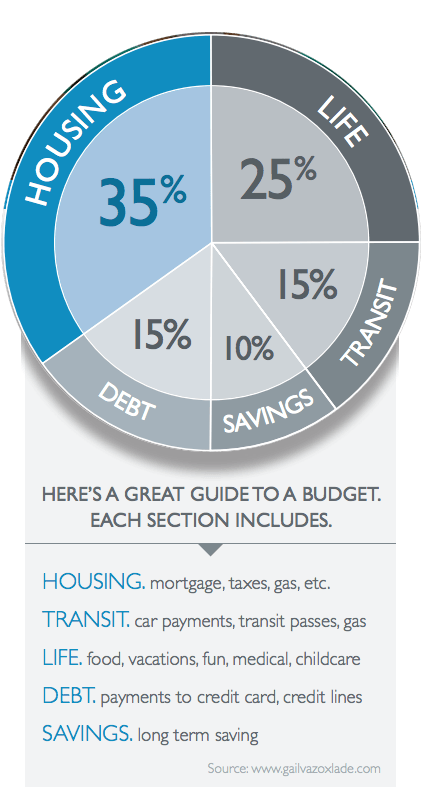

There are property taxes, maintenance, utilities and more due

every month. If those add up to 35% of your total income, you’re

on the right track.

If not you might have to sacrifice in other categories such as

vacation, debt repayment or savings. Take a look at the pie chart

to see how you can be life rich instead of house poor!

NEED HELP FITTING A HOME INTO YOUR BUDGET? CALL ME FOR HELP TODAY!

Rita Cousins Senior Mortgage Advisor

C 604 230 9206

F 1 877 282 0857

[email protected]

http://www.ritacousins.com

Homebuyers in Metro Vancouver are sitting on the sidelines despite market conditions tipping in their favour, according to the latest data from the Greater Vancouver Realtors (GVR). Residential home sales in March 2025 totalled just 2,091—down 13.4 per cent from March 2024 and 36.8 per cent below the 10-year seasonal average. It marked the slowest March for sales since 2019. Active listings climbing to highest levels seen in a decade At the same time, active listings reached levels not seen in nearly a decade. New listings for detached, attached and apartment properties were up 29 per cent year-over-year to 6,455—a 15.8 per cent increase over the 10-year average. Total active listings on the MLS reached 14,546, up 37.9 per cent compared to March 2024 and 44.9 per cent above the seasonal average. “If we can set aside the political and economic uncertainty tied to the new U.S. administration for a moment, buyers in Metro Vancouver haven’t seen market conditions this favourable in years,” said Andrew Lis, GVR’s director of economics and data analytics. “Prices have eased from recent highs, mortgage rates are among the lowest we’ve seen in years, and there are more active listings on the MLS than we’ve seen in almost a decade.” Read More