Canada's First Time Homebuyer Incentive Program

Rita Cousins Senior Mortgage Advisor • October 11, 2019

The new First-Time Home Buyer Incentive allows eligible first-time homebuyers, who have the minimum downpayment for an insured mortgage, to apply to finance a portion of their home purchase through a form of shared equity mortgage with the Government of Canada

HOW IT WORKS:

- Lower Monthly Mortgage Payments

- Interest-free Incentive Program

- No Pre-payment Penalty

- Newly Constructed Homes eligible for 5% or 10%

- Existing Homes eligible for 5%

How do I know if I qualify for this incentive?

At least one homeowner must be a first-time homebuyer,

which is considered as the following:

- You have never purchased a home before

- You have gone through a breakdown of marriage or common-law partnership (even if the other first-time home buyer requirements are not met)

- In the last 4 years you did not occupy a home that was occupied by the homebuyer or their spouse

How does my income affect qualifying for this incentive?

Your total qualifying income must be $120,000 per year or less. Remember you will still need to qualify the income requirements set out by lenders and mortgage loan insurers.

Do I still need Mortgage Loan Insurance?

Mortgages must be eligible for mortgage loan insurance through either Canada Guaranty, CMHC or Genworth. The first mortgage must be greater than 80% of the value of the property and is subject to a mortgage loan insurance premium.

The premium is based on the loan-to-value ratio of the first mortgage only. That is, the first mortgage amount divided by the purchase price. The Incentive amount is included with the total down payment.

Do I have to pay the government back?

The first-time homebuyer will be required to repay the Incentive amount after 25 years or when the property is sold, whichever comes first. The homebuyer can also repay the Incentive in full at any time, without a pre-payment penalty. Refinancing of the first mortgage will not trigger repayment.

How is repayment calculated?

Repayment is based on the property’s fair market value at the point in time where repayment is required. If you receive the 5% Incentive, you will pay 5% of the home’s current market value. If you received 10%, you will pay 10% of the home’s current market value.

Does this affect the type of property I can purchase?

Yes, there are some guidelines for the type of property, and the intention of ownership. Eligible residential properties include:

- New construction

- Re-sale home

- New and re-sale mobile/manufactured homes

Types of residential properties include:

- Single family homes

- Semi-detached homes

- Duplex

- Triplex

- Fourplex

- Town houses

- Condominium units

Depending on the eligible property type, the Government of Canada will offer 5% for a first-time buyer’s purchase of a resale home, and 5% or 10% for a first-time buyer’s purchase of a new construction. The property must be located in Canada and must be suitable and available for full-time, year-round occupancy. Additionally, you can NOT purchase the home with the intention of renting, as investment properties are not eligible.

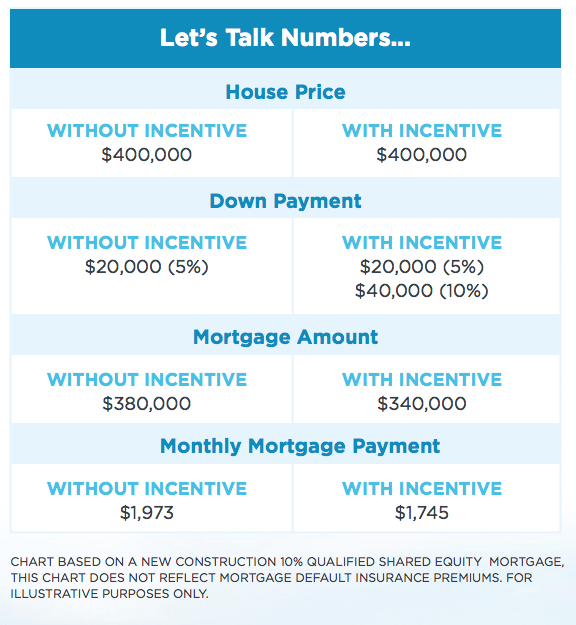

Without this new incentive, if you only have 5% down payment, your mortgage would be 95% of the purchase price plus the mandatory default insurance premium. Default insurance premiums are larger when you have a smaller down payment. With the new incentive, you now have up to 15% down payment (5% your own and 10% incentive) so your mortgage size is smaller and the insurance premium is also lower because the down payment is higher.

Always the goal for sleep quality. Check out LAPS for adoptables 😀 _____________________________________________________________________________________ 📣“Price is what you pay. Value is what you get.” - Warren Buffett _____________________________________________________________________________________ If you have any questions about the buying or selling process, I am here to help! Book some time to chat with me here. Andy Schildhorn Personal Real Estate Corporation - Macdonald Realty Address: 22424 Fraser Highway, Langley, BC, Canada, British Columbia Phone: +1 778-835-8957 Email: andy@andytherealtor.com Website: https://www.andytherealtor.com/

🏡 Why Walnut Grove is One of Langley’s Best Communities? 🌳THINKING ABOUT MOVING TO WALNUT GROVE, LANGLEY? This community offers tree-lined streets, stunning natural scenery, top-rated schools, and an unbeatable sense of community—making it one of the best places to call home in Langley! In this video, I’ll share why Walnut Grove is a top choice for families, professionals, and retirees, covering everything from local amenities, parks, schools, and real estate options to commuting, shopping, and lifestyle perks. Whether you're looking for a condo, townhome, executive home, or a quiet strata community, Walnut Grove has something for everyone. 📩 Want to stay updated on new listings and sold prices in Walnut Grove? ➡️ Sign up here: https://rly.forsale/Walnut-Grove 🏠 In This Video: ✅ What makes Walnut Grove so desirable? ✅ Top-rated schools, parks, and recreation ✅ Easy commuting to Vancouver, the U.S. border, and the Interior ✅ Shopping, dining, and local services ✅ Real estate options in Walnut Grove ✅ How to stay ahead of the market with my exclusive updates 📅 Let’s Chat About Your Move! Thinking about buying or selling in Walnut Grove? I’d love to help! 📅 Book a time to talk: https://rly.forsale/SchildhornGroup 📞 778.835.8957 📧 andy@andytherealtor.com 🌐 www.SchildhornGroup.com