Fire Alarm Smarts

Bjorn Rygg, Accredited Home Inspector • November 12, 2021

Smoke alarms are an important defense against injury or death in house fires. Here's what you need to know:

• As in real estate, location is key! Smoke alarms should be in installed every bedroom, outside every sleeping area, and on each level of the home.

• It's best to follow the manufacturer's instructions for placement, whether on the wall or ceiling. High, peaked ceilings have dead air space at the top; in these instances smoke alarms should be placed no closer than 3 feet from the highest point.

• There are two primary types of smoke alarm technology: ionization and photoelectric. According to the National Fire Protection Association, ionization alarms are more responsive to flames, while photoelectric alarms are more sensitive to smoldering fires. For the most comprehensive protection, both types or a combination unit should be installed.

• A common rule of thumb is to replace alarm batteries when changing to or from Daylight Saving Time in fall or spring. Many newer alarms have 10-year lithium batteries that eliminate the need for new batteries, but the unit itself must be replaced when the battery dies.

• If the alarms are hard-wired to the home's electrical system, make sure they are interconnected for maximum effectiveness – meaning that if one alarm is triggered, all of the others will sound as well.

• The newest type of interconnected smoke alarms are wireless. This technology allows detectors to communicate with one another and, like their hard-wired cousins, will sound all of the units even if just one is triggered initially.

Early alerting is key to surviving a fire. Following these simple but important measures allows occupants to be warned, helping to prevent injuries and fatalities.

If you have any further questions, feel free to contact me

Bjorn Rygg 604-532-0530

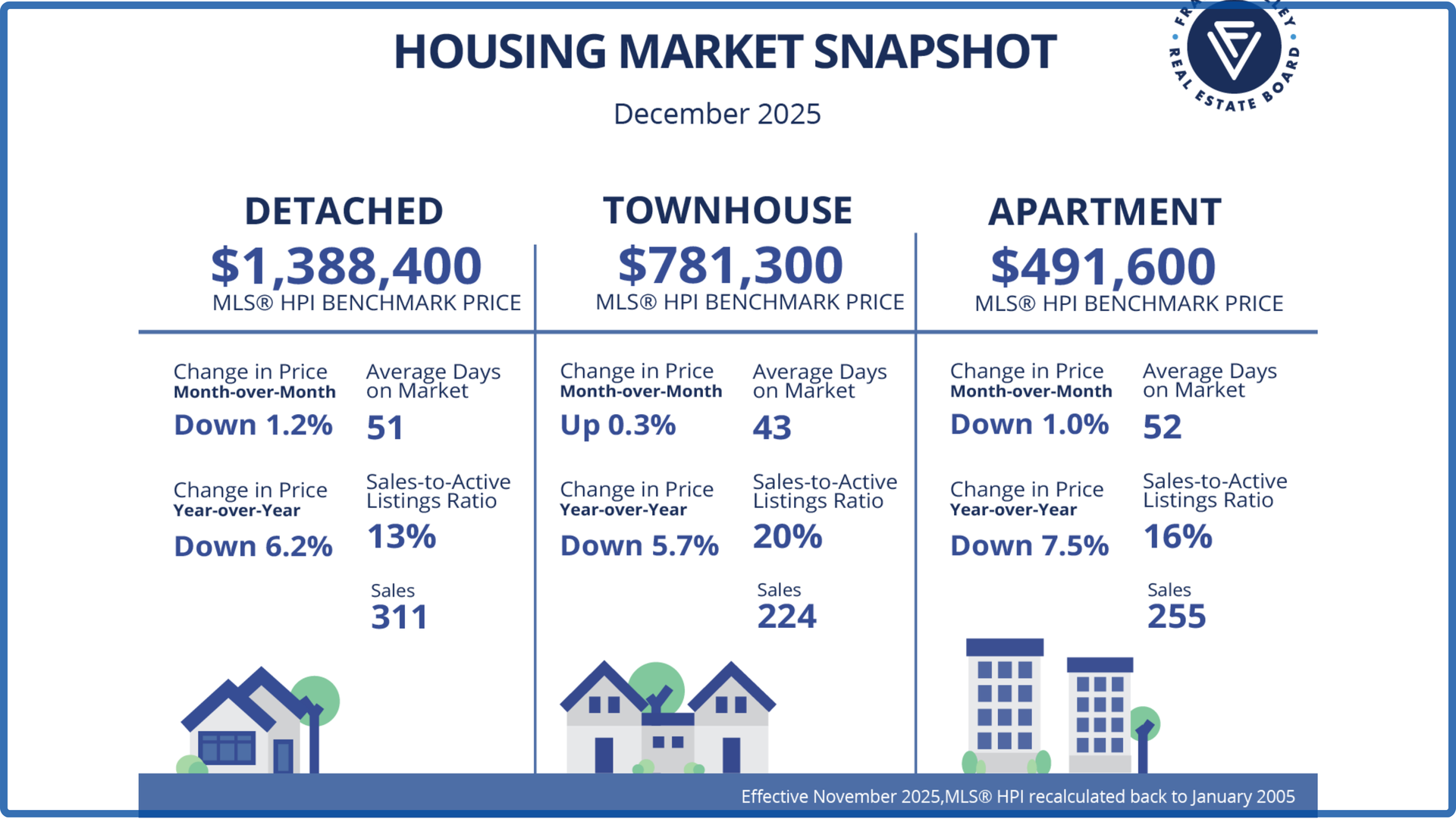

SURREY, BC – Decade-high inventory and softer prices failed to spark buyer demand in the Fraser Valley in 2025. Despite favourable conditions and increased negotiating power, many buyers stayed on the sidelines, making it one of the slowest years for sales in decades. The Fraser Valley Real Estate Board recorded 12,224 sales on its Multiple Listing Service® (MLS®) in 2025, a decline of 16 per cent over 2024 and 33 per cent below the 10-year average. The City of Surrey accounted for the majority of 2025 sales at 48 per cent, with Langley and Abbotsford accounting for 24 per cent and 16 per cent respectively. On the supply side, buyers had more choice than at any point in the past four decades, as new listings climbed to 37,963. The composite Benchmark home price in the Fraser Valley closed the year at $905,900, down six per cent year-over-year, and down 24 per cent from the peak in March 2022.

The number of court-ordered sales in Metro Vancouver is jumping, and may continue to grow as a mortgage renewal wave hits Canada five years after the pandemic-era real estate frenzy. Court-ordered inventory, while less than one per cent of the market, totalled 119 properties in the Vancouver region in October 2025, compared with 66 in October 2024 and 28 in October 2023, according to real estate website Zealty.ca (Zealty Online Search Inc.). Foreclosures are becoming more frequent because home prices are correcting, unemployment is rising and people who bought during the pandemic are having to renew their mortgages at higher interest rates, said Adam Major, managing broker with Sechelt-based Holywell Properties. There was a massive increase in home sales from late 2020 through 2022, he said. “This was the height of COVID craziness when [Bank of Canada governor] Tiff Macklem promised rates would stay low forever, the government was sending everyone free money and we all wanted a bigger house to work from home in,” he said. Those homes were financed at rock-bottom interest rates, with the central bank’s policy rate sitting at 0.25 per cent from March 2020 to March 2022. Because Canadian banks generally offer maximum terms of five years, it’s now time for many to pay the piper—at interest rates higher than what some can afford. “It is definitely a bad sign for the market as we are only at the beginning of the big mortgage renewal wave,” Major said. The most sales ever in a month in the region were the 5,715 sales in March 2021, he said. “Those buyers will have to renew this coming March. The number of renewals will stay elevated for a year after that. The average discount mortgage rate in March 2021 was 1.69 per cent versus about 3.79 per cent now, so almost everyone who bought in 2021 and 2022 will be paying significantly more on renewal,” he said. 👉 Read the Article Here