Did you receive a Speculation tax declaration?

Irina Bartnik Notary • February 12, 2020

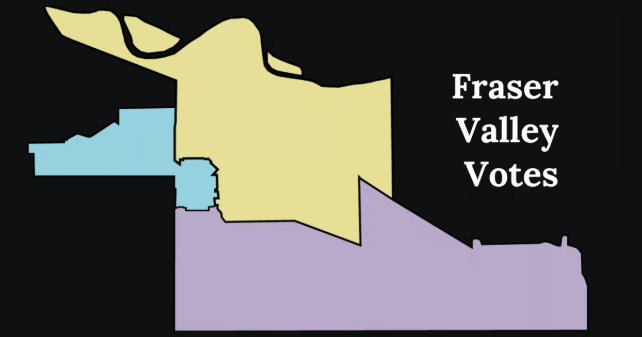

This is second year now that residential property owners must complete annual declaration for the Speculation and vacancy tax. This tax is applicable only to certain designated taxable regions.

If your home was or is located in the designated area, it is your responsibility to file the declaration. If you do not file the declaration, you will be assessed for a speculation tax. Unlike Vancouver empty home tax, Speculation tax does not get attached to the property. It is attached to the home owner that owned the property (was registered owner in Land Title office) as of December 31st, 2019.

Please visit this web site

for more information on how to file and determine if your property is subject to Speculation tax:

Most of us will receive the notice with no problem and will file the declarations. Those that sold the property in the beginning of this year (2020) and moved to a different home may miss the notices that were sent out in the mail. If you know someone that sold the property recently, please talk to them and bring awareness that they still need to file a Speculation tax notice , even if they did not receive it in the mail. You may save them a lot of money and stress.

Homebuyers in Metro Vancouver are sitting on the sidelines despite market conditions tipping in their favour, according to the latest data from the Greater Vancouver Realtors (GVR). Residential home sales in March 2025 totalled just 2,091—down 13.4 per cent from March 2024 and 36.8 per cent below the 10-year seasonal average. It marked the slowest March for sales since 2019. Active listings climbing to highest levels seen in a decade At the same time, active listings reached levels not seen in nearly a decade. New listings for detached, attached and apartment properties were up 29 per cent year-over-year to 6,455—a 15.8 per cent increase over the 10-year average. Total active listings on the MLS reached 14,546, up 37.9 per cent compared to March 2024 and 44.9 per cent above the seasonal average. “If we can set aside the political and economic uncertainty tied to the new U.S. administration for a moment, buyers in Metro Vancouver haven’t seen market conditions this favourable in years,” said Andrew Lis, GVR’s director of economics and data analytics. “Prices have eased from recent highs, mortgage rates are among the lowest we’ve seen in years, and there are more active listings on the MLS than we’ve seen in almost a decade.” Read More