The Rate Today

In order to find out how the current rate impacts Canadian consumers, we must first identify insured and uninsured borrowers.

Do you have less than 20% down?

Qualifying with less than 20% down

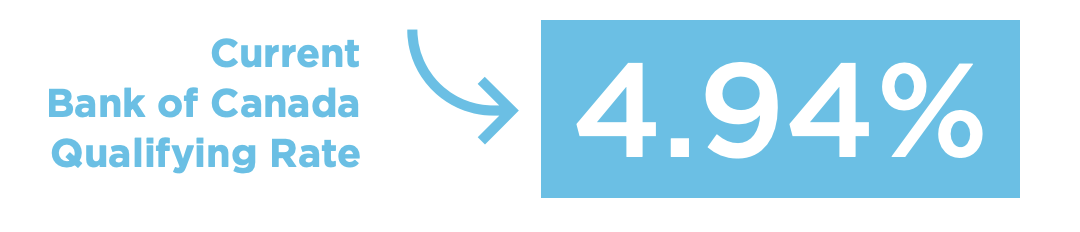

All insured mortgages need to qualify using the Bank of Canada’s Conventional 5 year fixed posted rate (also referred to as the Benchmark Rate). The current rate is 4.94%. Once qualified, a mortgage broker will then start to shop the market to get the best financing options. Once the right fit is found, the rate presented is called the Contract Rate, and is what mortgage payments are based upon.

Since this is considered a high-ratio/insured buyer, in most cases, the default insurance premium is added to the mortgage balance so the buyer is not out of pocket. However in doing so, this means the buyer is charged the mortgage interest rate on the insurance premium amount.

Default insurance protects the lender, which reduces its risk and that is why mortgage rates are typically lower for insured transactions.

Do you have more than 20% down?

Securing an uninsured mortgage (otherwise known as a lowratio/ conventional mortgage) means applying for a mortgage that meets one of the following criteria:

- It is a purchase of $1 million or more

- A minimum down payment of 20%

- The purchase of a non-owner occupied single-unit rental;

- Refinancing (i.e. replacing the current mortgage loan with an increased mortgage size)

Qualifying with more than 20% down

To qualify for an uninsured mortgage, it is mandatory to use the higher of the two rates; the contract rate + 2% OR the Bank of Canada’s 4.94% qualifying rate. These mortgages can have 30 year amortizations and have a home value of any size. Conventional mortgages are higher risk for lenders as they are without the protection of default insurance, hence the rates tend to be slightly higher for a conventional mortgage.