SURREY, BC — In a year that saw prices peak early on, feeding off the momentum of record-breaking sales in 2021, the Fraser Valley real estate market came back down to earth by the close of 2022, due largely to interest rate increases designed to stave off inflation.

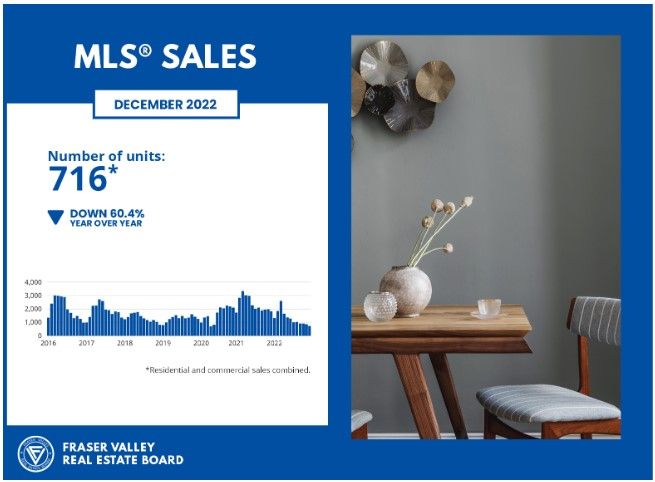

The Fraser Valley Real Estate Board (FVREB) processed 716 sales on its Multiple Listing Service® (MLS®) in December 2022, down 14.7 per cent from the previous month and down by 60.4 per cent compared to the same month last year, making it the lowest December sales recorded in the last 10 years.

The Board received 803 new listings in December, a decrease of 52.8 per cent compared to November, and 37.2 per cent fewer than December of last year. Total active listings for December stood at 3,923, down by 26.4 per cent compared to November, but nearly double (100.5%) compared to December 2021.

The year closed out with a total of 15,273 sales, just over half of 2021’s record-setting 27,692 and the ninth-lowest annual tally of the past decade. New listings were down 8.9 per cent at 32,442 compared to 2021.

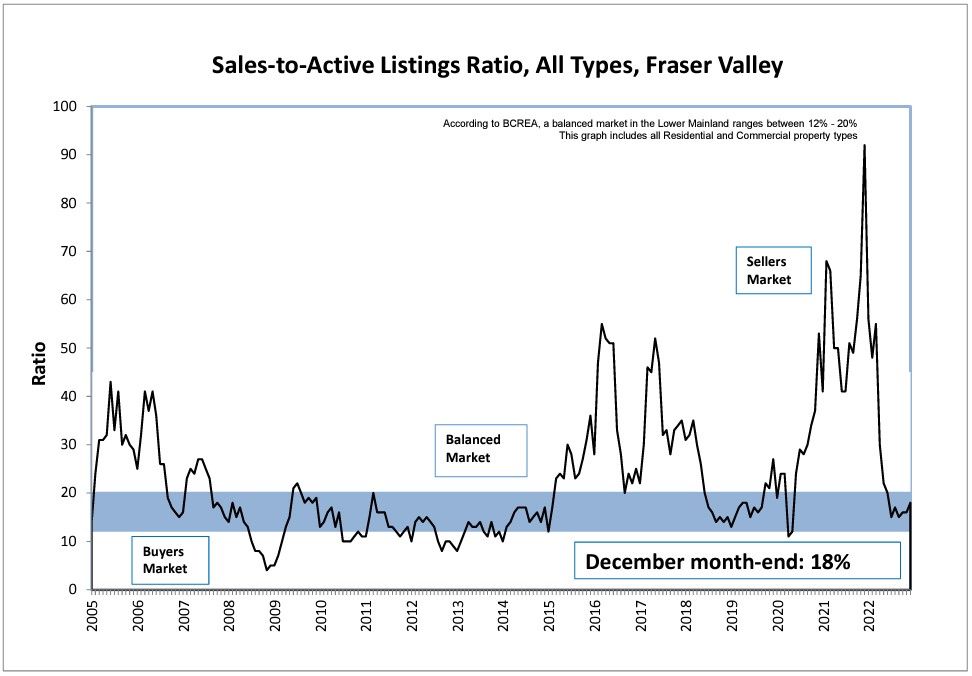

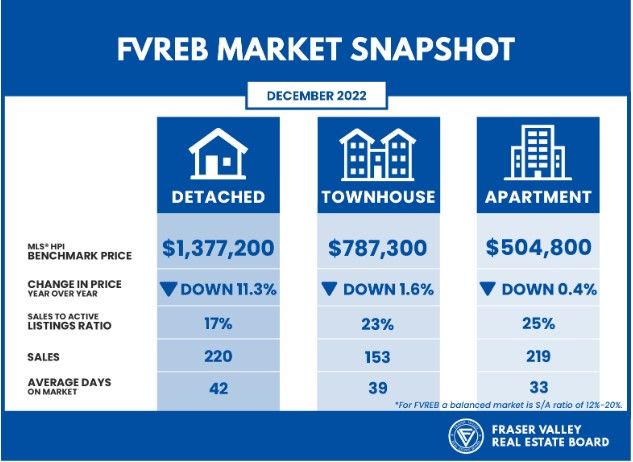

With a sales-to-active listings ratio of 18 per cent, the overall market closed out the year in balance (the market is considered balanced when the sales-to-active listings ratio is between 12 per cent and 20 per cent.).

“As the market has adjusted to rate hikes, we’re starting to see a resumption of interest among the public,” said Sandra Benz, President of the Fraser Valley Real Estate Board. “For some time, buyers and sellers alike have delayed decisions in somewhat of a watch-and-wait mode. This has dampened sales as well as supply since fewer new listings come onto the market. We expect activity to pick up in the coming months as this pent up supply and demand starts to emerge.”

Benz added that, under more stable market conditions, there will be strong opportunities for well-priced, well-positioned properties across all categories.

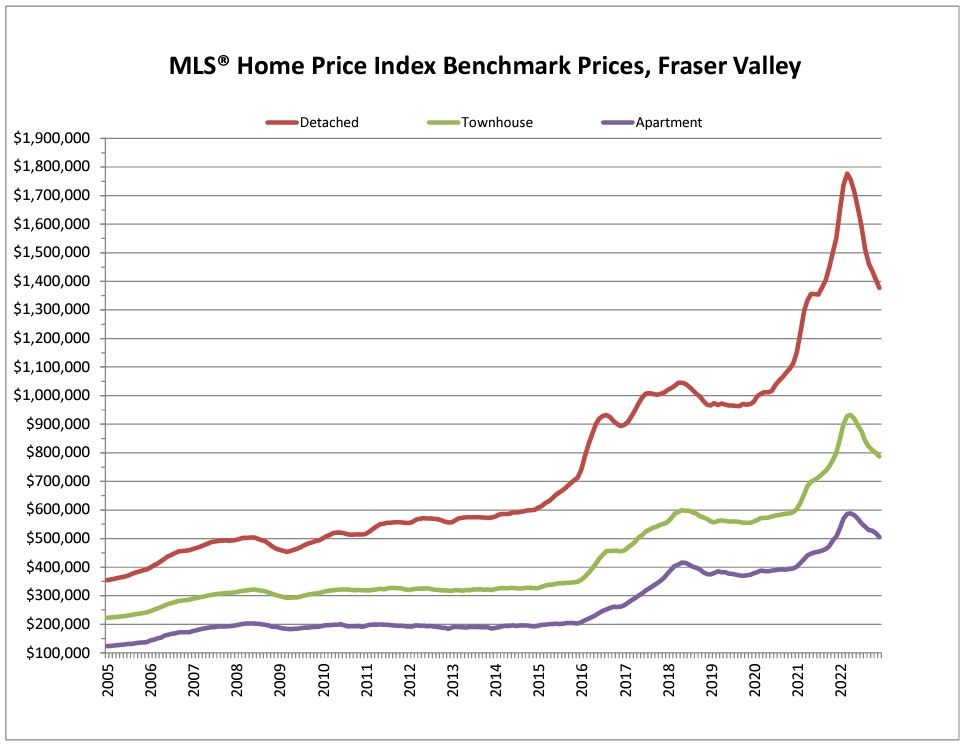

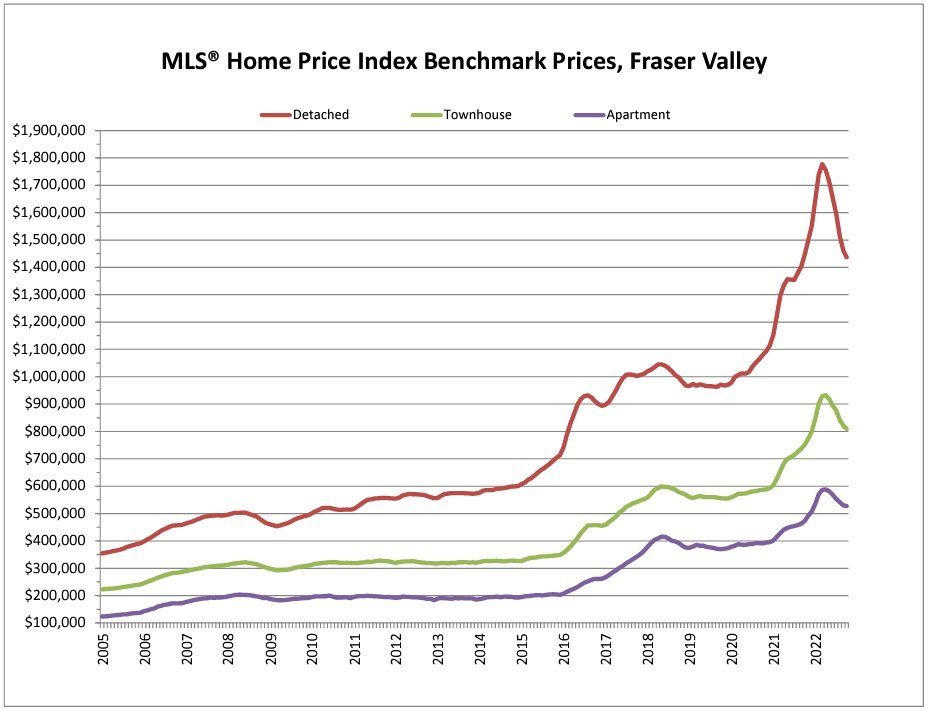

Home prices peaked in March of this year, with the Benchmark price for a detached house hitting a record $1,776,700 before closing out the year at $1,377,200. The composite Benchmark price (all property types combined) finished the year under one million at $955,700.

“If the real estate market has shown us anything this year, it’s that we must be prepared to adjust and adapt to uncertainty,” said Board CEO Baldev Gill. “Market reaction to the many variables at play — be they interest rates, regulatory changes or supply chain issues, for example — is tough to predict at the best of times. It requires detailed analysis and intimate knowledge, often down to the street level, to fully evaluate. Only a professional REALTOR® can provide the kind of intelligence required to ensure a decision to buy or sell is made with clients’ best interests in mind.”

Across the Fraser Valley in December, the average number of days to sell a single-family detached home was 42 and a townhome 39 days. Apartments took, on average, 33 days to sell. A year ago, properties were moving, on average, two to three times more quickly.

MLS® HPI Benchmark Price Activity

All Rights Reserved | Andy Schildhorn Personal Real Estate Corporation | Created by M.A.P | Powered by Conscious Commerce Corporation