📉 Rising home sales a sign of market shift in the Fraser Valley? 🏡

SURREY, BC — Home sales in the Fraser Valley increased for the first time in five months following a sizable interest rate cut by the Bank of Canada in October.

The Fraser Valley Real Estate Board recorded 1,330 sales in October, up 35 per cent from September, and 37 per cent year-over-year.

“After waiting it out on the sidelines for a number of months, buyers seem to be finally responding to the series of successive rate cuts by the Bank of Canada,” said Jeff Chadha, Chair of the Fraser Valley Real Estate Board. “Whether this is an indication of further sales trends remains to be seen, especially as the feds eye a possible additional cut before year-end.”

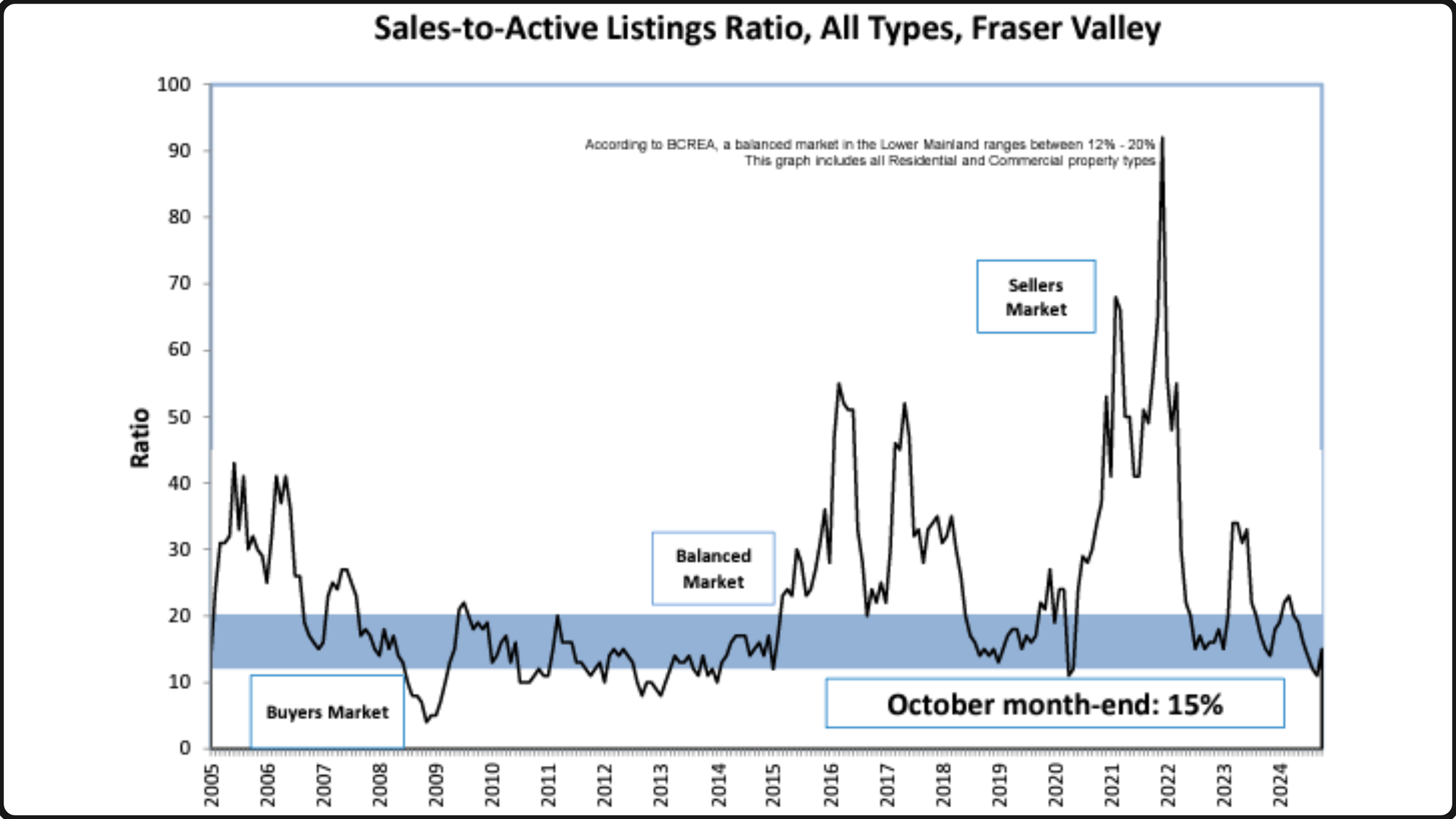

New listings declined in October, down 5 per cent to 3,194, but increased 26 per cent year-over-year. Overall inventory dipped in October to 8,799, down three per cent from September, but up 34 per cent over last year. Rising sales and steady inventory levels have the Fraser Valley in a balanced market with a sales-to-active ratio of 15 per cent. The market is considered to be balanced when the ratio is between 12 per cent and 20 per cent.

“October’s healthy sales boost is a welcome development for buyers and sellers alike,” said Baldev Gill, CEO of the Fraser Valley Real Estate Board. “The coming weeks and months will shed more light on whether buyer optimism has returned now that the cycle of interest rate cuts is in full swing.”

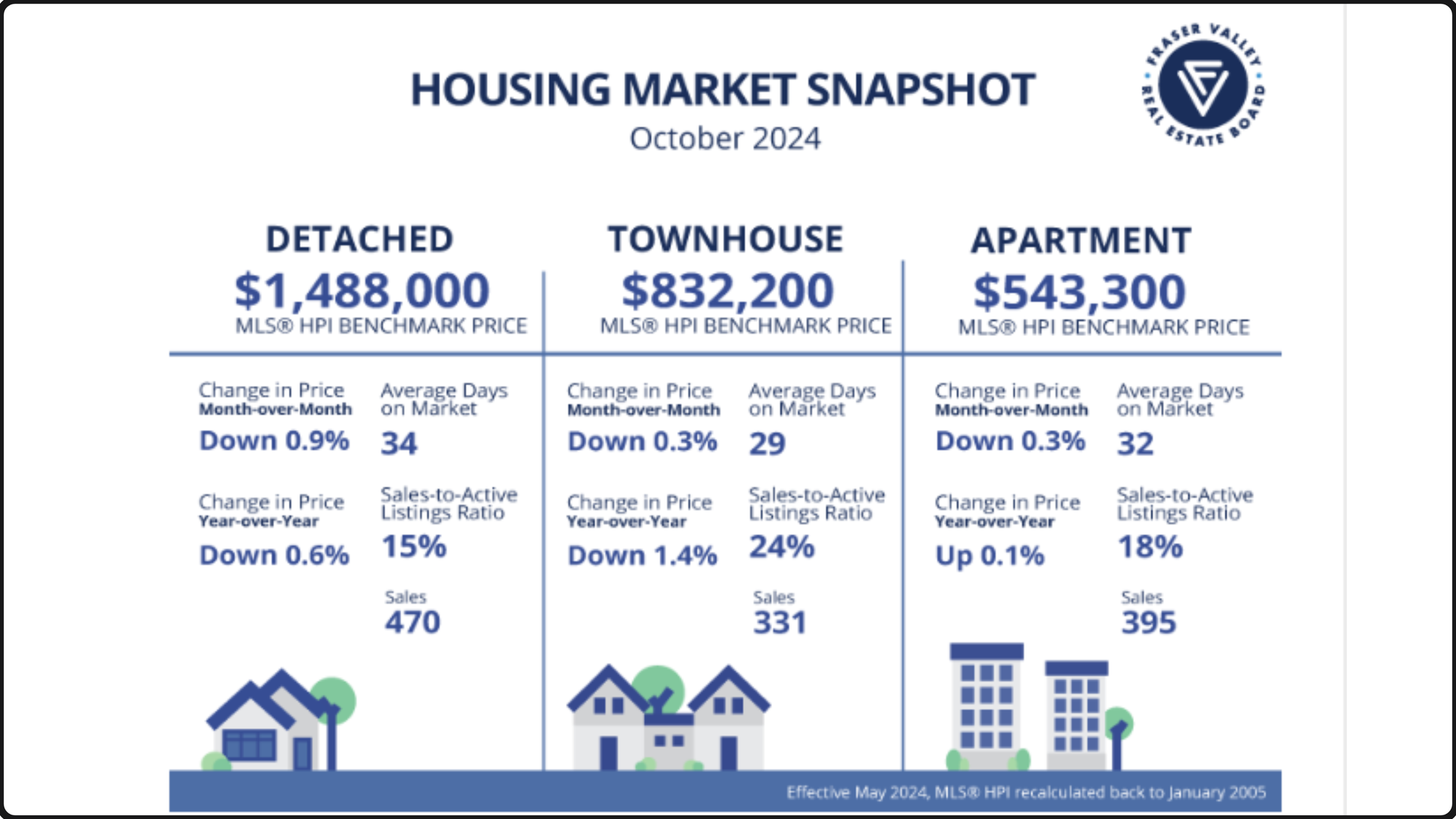

Across the Fraser Valley in October, the average number of days to sell a single-family detached home was 34, while for a condo it was 32. Townhomes took, on average, 29 days to sell.

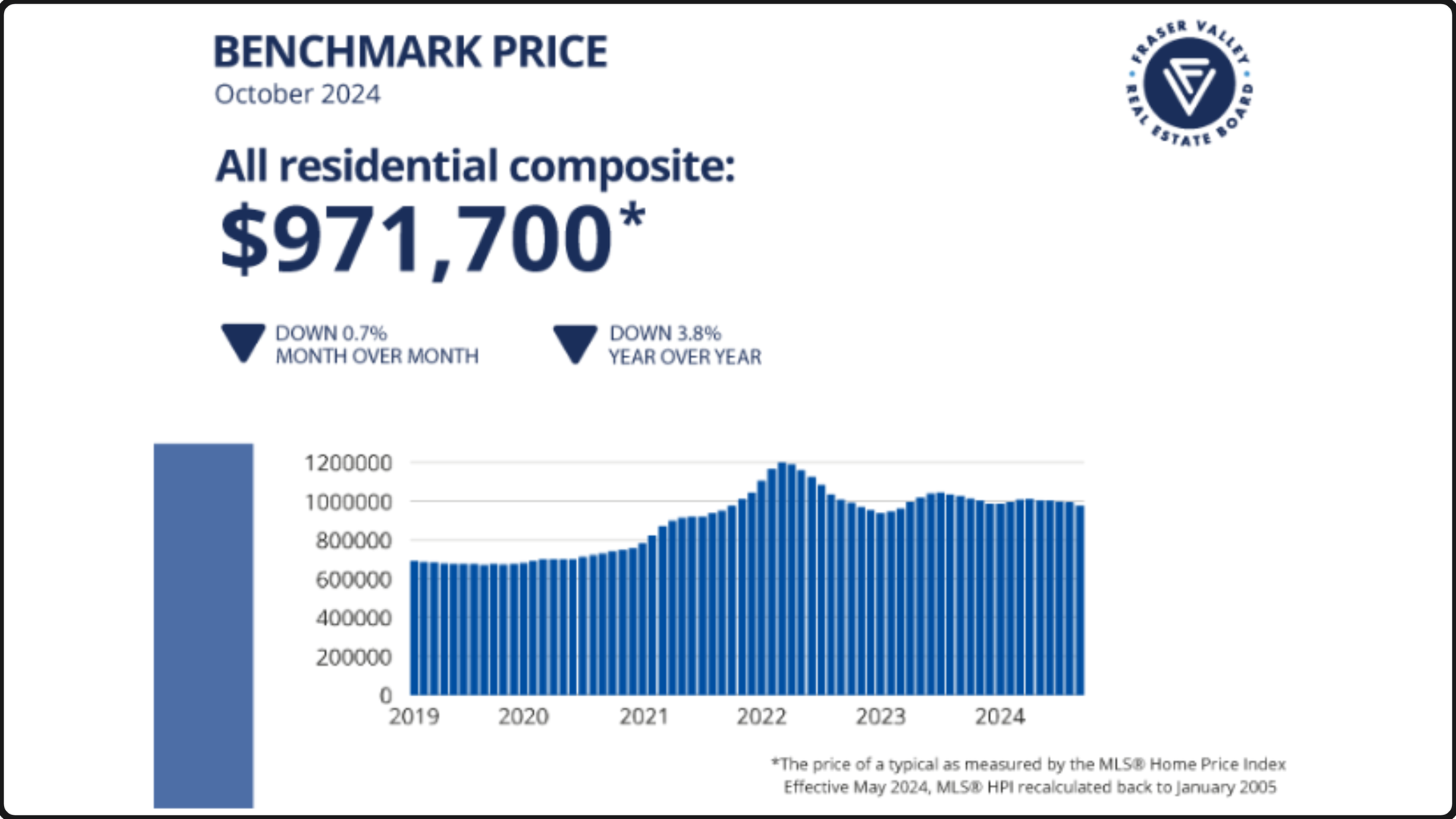

Benchmark prices in the Fraser Valley dipped for the seventh straight month in October, with the composite Benchmark price down 0.7 per cent to $971,700.

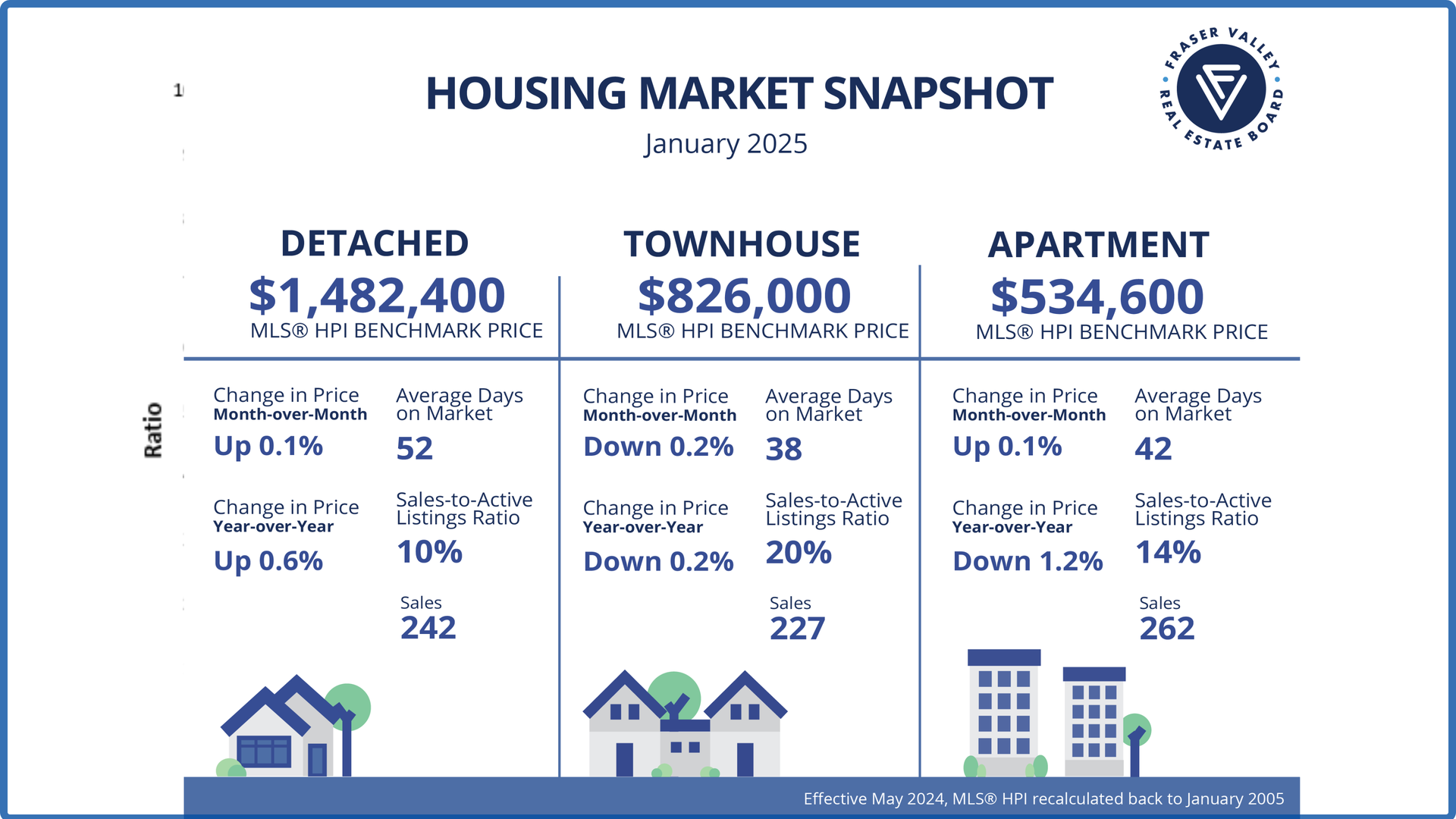

MLS® HPI Benchmark Price Activity

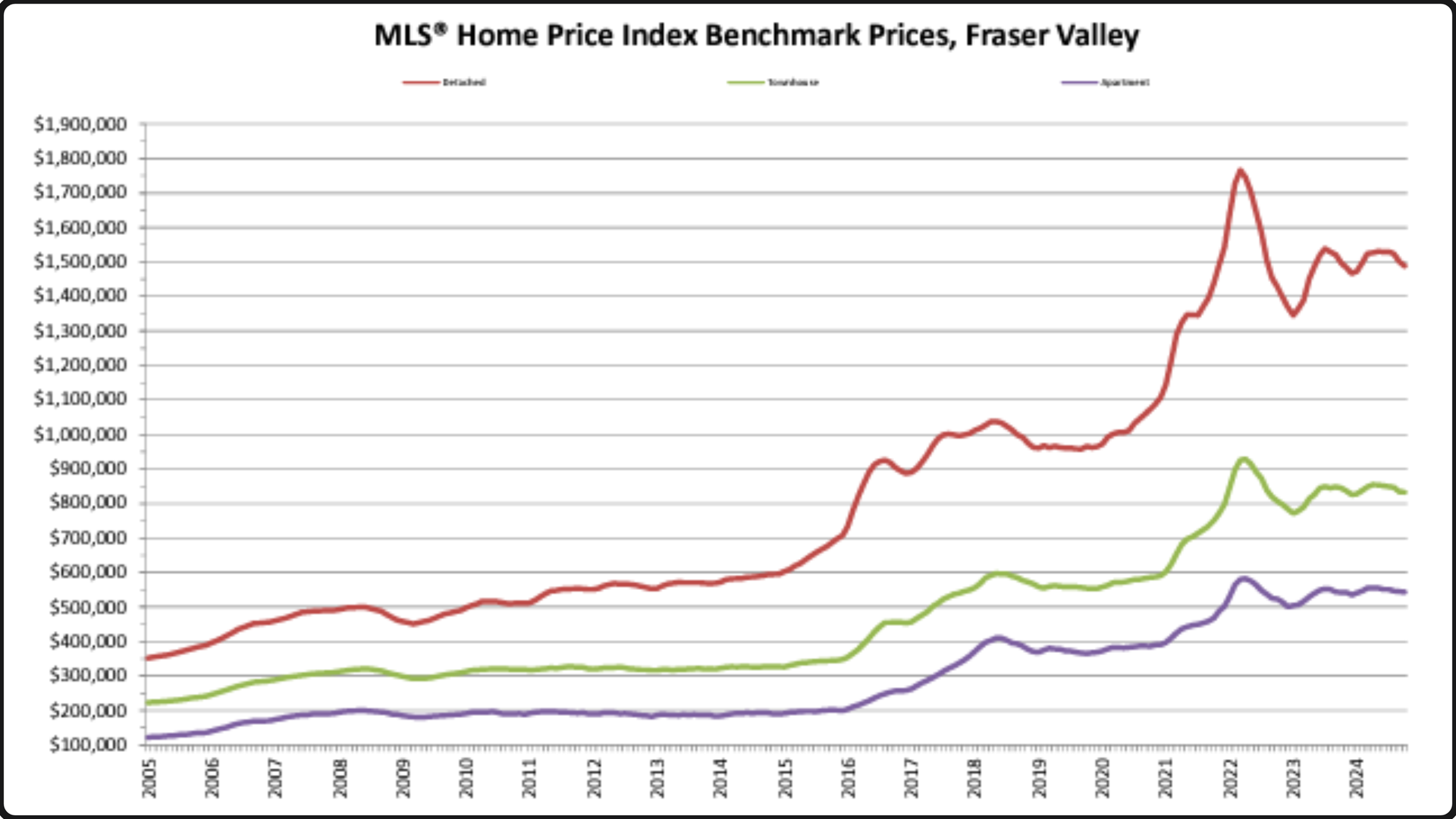

- Single Family Detached: At $1,488,000, the Benchmark price for an FVREB single-family detached home decreased 0.9 per cent compared to September 2024 and decreased 0.6 per cent compared to October 2023.

- Townhomes: At $832,200, the Benchmark price for an FVREB townhome decreased 0.3 per cent compared to September 2024 and decreased 1.4 per cent compared to October 2023.

- Apartments: At $543,300, the Benchmark price for an FVREB apartment/condo decreased 0.3 per cent compared to September 2024 and increased 0.1 per cent compared to October 2023.

All Rights Reserved | Andy Schildhorn Personal Real Estate Corporation | Created by M.A.P | Powered by Conscious Commerce Corporation